Ontario’s real estate landscape has always been dynamic, but a new story is emerging – one shaped by shifting migration patterns, changing affordability, and growing demand for flexible living options. Investors across the province are paying close attention, not just to major urban centres, but to the smaller and mid-sized communities that are quietly transforming into the best places to invest in Ontario.

Whether you’re a first-time investor looking for a safe entry point or a seasoned buyer ready to expand your portfolio, choosing the right market has never been more important. With interest rates stabilizing and rental demand continuing to rise, the coming years offer promising opportunities – especially in regions benefiting from population growth, new infrastructure, and improved affordability.

So what are the best places to invest in Ontario? From thriving commuter cities to lifestyle-driven small towns, Ontario is filled with markets that show compelling long-term potential. This guide highlights the communities standing out today – and the trends that may shape the province’s investment landscape far into the future.

Understanding Why Ontario Investors Are Looking Beyond the Big Cities

For years, Toronto dominated the conversation around real estate investment. While it continues to be one of Canada’s most resilient markets, investors are increasingly widening their search. Affordability challenges, rising carrying costs, and competition have pushed many to explore neighbouring regions – areas where rental demand is strong, purchase prices are manageable, and long-term appreciation offers attractive upside.

What’s driving this shift in the best places to invest in Ontario? Part of it is lifestyle-driven migration. Many Ontarians are prioritizing space, nature, suburban communities – especially remote workers who no longer depend on city-centre commutes. Another factor is the expansion of infrastructure: new transit corridors, highway improvements, and regional economic investments are making smaller communities more accessible and more appealing to a broader group of renters.

Perhaps most importantly, the Ontario rental market remains undersupplied. With vacancy rates low across the province, investors who choose strategically can expect a steady stream of tenants, especially in markets with growing populations, expanding job opportunities, and a healthy mix of housing types.

As you explore potential investment opportunities, staying focused on fundamentals – population growth, rental demand, property taxes, and local employment trends – will give you a significant advantage.

Markets Showing Strong Momentum Heading Into 2025

Several markets are emerging as the best places to invest in Ontario for investors. These cities and towns offer a blend of affordability, rental demand, and long-term growth that positions them well for 2025 and beyond.

Take Ottawa, for example. As the nation’s capital, it benefits from stable government employment, strong universities, and a consistent influx of professionals and students. Rental demand remains high, and neighbourhoods just outside the city core often deliver better cash-flow potential than central locations. Investors appreciate Ottawa’s predictability – it’s a market that rarely swings dramatically, making it attractive for those looking for long-term stability.

Another region marked as one of the best places to invest in Ontario is Kitchener-Waterloo-Cambridge. With a rapidly growing tech sector, multiple post-secondary institutions, and significant immigration-driven population growth, the area continues to expand at a rate that supports both strong rental demand and rising property values. The LRT system has also encouraged development along transit routes, creating new opportunities for investors looking for strategic long-term holds.

Then there’s the Durham Region. Once considered a quieter corner of the GTA, cities like Oshawa, Whitby, Ajax, and Pickering have seen strong demand from buyers and renters alike, driven by more attainable price points and proximity to Toronto. As housing affordability challenges persist in the core GTA, Durham’s appeal is unlikely to slow down.

Meanwhile, mid-sized cities such as London, Guelph, and Barrie continue to thrive due to a combination of job growth, relative affordability, and rapidly growing populations. These are cities that renters flock to – students, young professionals, families, and newcomers – making them reliable for long-term cash flow.

Finally, Ontario’s small-town boom continues. Communities like St. Thomas, Belleville, Arnprior, Orillia, and Collingwood are attracting remote workers, retirees, and families seeking lifestyle-driven living. Their growing amenities and lower price points create accessible entry opportunities for new investors.

Rental Demand Remains a Key Driver of Investment Potential

When evaluating the best places to invest in Ontario., rental demand is just as important as purchase price. Ontario continues to face a rental housing shortage, resulting in low vacancy rates across many cities – and rising demand in communities with strong employment sectors or universities and colleges.

What makes these markets especially interesting is that rental demand isn’t just coming from students or young professionals. Families, newcomers, and remote workers are all contributing to the need for more housing options. This diversity of tenant profiles gives investors flexibility in choosing property types – whether single-family homes, accessory dwelling units, multiplexes, or condos.

Even with future interest rate adjustments expected to create more balance in the market, Ontario’s rental landscape is unlikely to soften meaningfully in the near future. The combination of population growth and limited supply continues to position the province as a strong environment for long-term investors. These factors allow first-time investors to turn their initial investment into a smart one.

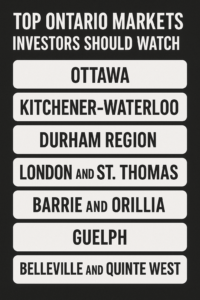

Top Ontario Markets Investors Should Watch Closely

Each year, a handful of Ontario communities stand out for their unique combination of affordability, rental demand, and growth potential. As we look toward 2026 and beyond, these markets are particularly worth watching:

- Ottawa for its stability and strong government-driven employment base.

- Kitchener-Waterloo-Cambridge for tech growth, education, and long-term appreciation potential.

- Durham Region for affordability relative to the GTA and strong commuter appeal.

- London and St. Thomas for population growth and increasing demand from newcomers.

- Barrie and Orillia for lifestyle appeal, strong rental markets, and improving infrastructure.

- Guelph for low vacancy rates, strong local employment, and rising student demand.

- Belleville and Quinte West for affordability and growing interest from remote workers and retirees.

This is not an exhaustive list, but these markets represent some of the best places to invest in Ontario as investors refine their strategies for the next few years.

How 2025 Trends Will Shape Investment Success in the Years Ahead

As we look toward the next investment wave in Ontario, several trends stand out. Stabilizing interest rates are giving investors more predictability as they evaluate borrowing costs and long-term returns. Population growth continues to fuel rental demand, while ongoing affordability challenges in major cities are attracting buyers and renters to surrounding communities.

Local economic development – new hospitals, schools, manufacturing plants, tech expansions, and infrastructure projects – remains a major indicator of where demand will grow. When jobs come, housing demand follows.

For investors, staying ahead of these trends isn’t just about choosing the right market – it’s about choosing the right moment. Timing matters, but preparation matters more. Understanding your borrowing power, evaluating cash flow potential, and building a long-term strategy are essential steps toward making confident decisions in any market.

If you’d like help evaluating Ontario’s top opportunities or mapping out your investment strategy, consider reaching out to a trusted representative as your initial starting point.

Lisa’s Tip: Follow the Growth, Not the Headlines

Real estate headlines can be dramatic, but investors know that long-term success comes from watching the fundamentals. Follow population growth, infrastructure expansion, rental demand, and economic investment – not day-to-day price fluctuations. The markets building these foundations today are the ones that tend to outperform for decades.

Whether you’re starting your first investment journey or expanding an established portfolio, Ontario offers vibrant, resilient, and diverse opportunities. With the right strategy and a specialized realtor that knows where growth is heading, your next great investment could be just one thoughtful decision away.