For many Ontarians, buying a home isn’t just about finding a place to live – it’s about laying the groundwork for long-term financial security. Real estate investing has proven time and again to be one of the most reliable paths to building wealth, and for good reason: it’s tangible, it appreciates over time, and it creates opportunities for income and equity growth that other investments can’t easily match.

If you’re preparing to buy your first property – whether you plan to live in it, rent it out, or a bit of both – approaching the purchase with an investor mindset can make a world of difference. By thinking strategically from the start, you can turn your first home into a foundation for future opportunity.

Why Real Estate Remains a Trusted Wealth Builder

There’s a reason generations of Canadians have turned to Real estate investing as their primary wealth-building tool. Unlike volatile markets that rise and fall overnight, property values tend to grow steadily over time, particularly in a province like Ontario where population growth, strong demand, and limited housing supply continue to shape the landscape.

Every mortgage payment you make builds equity – the difference between your home’s market value and what you owe on it. Over the years, that equity can become a powerful financial asset, giving you flexibility to refinance, invest in other properties, or fund life’s major milestones.

Even when markets fluctuate, real estate offers something that few other investments do: utility. You can live in it, rent it, or leverage it. That inherent value gives property ownership a stability that stocks or digital assets can’t replicate.

Thinking Like an Investor, Even as a First-Time Buyer

Adopting an investor mindset doesn’t mean you need to become a landlord right away. It means viewing your purchase through a strategic lens: how will this property perform over time? What potential does it have to grow in value or generate income?

When you look at homes with these questions in mind, you start to see possibilities others might miss. Maybe a modest starter home in a suburban community offers better long-term appreciation than a trendy condo downtown. Or perhaps a duplex lets you live in one unit while renting out the other – covering part of your mortgage each month.

The key is to balance personal comfort with financial foresight. The best first properties meet your immediate needs while positioning you for future opportunities.

Identifying Properties with Investment Potential

Spotting an undervalued or high-potential property takes a blend of market knowledge, location awareness, and a bit of creative thinking. Here are a few factors to keep in mind:

- Look for areas with growth signals.

Neighbourhoods near transit expansions, universities, or new commercial development often see stronger price appreciation over time. A home that’s well-located today could be in an even more desirable area five years from now. - Focus on fundamentals over flash.

It’s easy to be drawn to modern finishes or open-concept layouts, but true investment value often lies in things like solid construction, lot size, and neighbourhood quality. Cosmetic updates can always come later. - Understand the local rental market.

Even if you don’t plan to rent immediately, knowing what similar properties command in rent gives you a sense of long-term income potential. In many Ontario cities, strong rental demand supports solid returns for well-located properties. - Think resale, not just resale price.

Choose a property that will appeal to future buyers and tenants – proximity to schools, amenities, and transportation consistently adds value.

The Power of Resale Homes in Today’s Market

In a market where new construction has slowed and costs remain high, resale properties (existing homes) have become an increasingly smart choice for first-time buyers and aspiring investors.

Resale homes often come with mature neighbourhoods, established amenities, and a clearer sense of market value. You can see exactly what you’re buying – and often negotiate on real data rather than pre-construction promises. Many resale homes also offer opportunities for value-add improvements, such as basement suites, energy efficiency upgrades, or strategic design that enhance both comfort and future value.

For investors, these “light lift” opportunities can create significant returns. A refreshed kitchen, updated flooring, or finished basement not only increases resale potential but can also justify higher rental income.

Understanding Cash Flow and Equity Growth

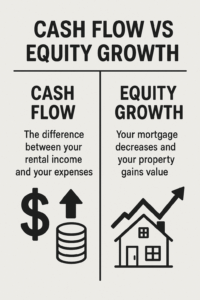

To build wealth through real estate investing, it helps to understand two key financial forces: cash flow and equity growth.

Cash flow refers to the difference between your rental income and your expenses (mortgage, taxes, insurance, and maintenance). Positive cash flow means your property generates income each month, while neutral or negative cash flow might still make sense if the property’s long-term appreciation outweighs short-term costs.

Equity growth, on the other hand, happens as you pay down your mortgage and your property’s value increases. Over time, this compounding effect can turn a modest first home into a substantial financial asset.

The balance between cash flow and appreciation for real estate investing depends on your goals. Some investors prioritize steady income, while others focus on long-term wealth creation. The key is to evaluate each opportunity holistically – with both numbers and lifestyle in mind.

Financing with an Investor’s Mindset

Financing is one of the most powerful tools for real estate investing, and understanding how to use it wisely is crucial.

Start by exploring your mortgage options early. Lenders offer different programs for owner-occupied homes versus investment properties, and knowing the requirements upfront will help you plan strategically. For example, if you plan to live in one unit of a duplex and rent out the other, you may qualify for more favourable terms than if you were purchasing a purely rental property.

You can also use financing creatively over time. As your home gains value and your mortgage balance decreases, you may be able to access that built-up equity through refinancing or a home equity line of credit (HELOC). That equity can then become the down payment for your next property, allowing you to expand your portfolio without starting from scratch.

Working with a financial advisor or mortgage specialist who understands real estate investing can help you structure your financing in a way that supports growth while maintaining financial security.

Why the Right Realtor Makes All the Difference

Turning your first property into a wealth-building asset requires more than just market timing – it takes insight, strategy, and a partner who understands how to translate your goals into action.

A realtor with investment experience can help you identify properties with strong fundamentals, understand local rental trends, and negotiate with both short-term affordability and long-term value in mind. They’ll also know how to spot red flags that could limit your returns, such as overbuilt areas, unrealistic price expectations, or properties requiring more work than they’re worth.

Lisa Awgu brings this investor-focused approach to every client relationship. She helps buyers see beyond curb appeal, evaluating each property’s earning and growth potential while ensuring it aligns with your financial comfort zone.

Lisa’s Tip: Start Small, Think Big

You don’t need to buy a multi-unit property to start real estate investing. The key is to make your first purchase with intention. Choose a property you can comfortably afford, understand your numbers, and look for opportunities to improve or leverage it over time.

Many successful investors started with one home – then used the equity from that first property to build a portfolio. The process takes patience and planning, but the rewards can be life-changing.

Building Wealth, One Step at a Time

Turning your first home into an investment isn’t about flipping houses or chasing quick returns. It’s about building stability, creating options, and setting yourself up for long-term financial growth.

When you approach your purchase strategically – focusing on fundamentals, understanding financing, and working with a realtor who knows how to guide you – your home becomes more than a place to live. It becomes a cornerstone of your financial future.

If you’re ready to explore how to make your first property a smart investment, connect with Lisa for help finding the right property, the right strategy, and the confidence to start your real estate investment journey in Ontario.